Neuseeland

Updates anzeigen

Updates anzeigen

Zusammenfassung

Der erfolgreiche Umgang mit steuerrechtlichen Vorgaben weltweit ist ein komplexes und ressourcenintensives Unterfangen. Jedes Land hat spezifische gesetzliche Vorschriften für die elektronische Rechnungsstellung, die sich ständig weiterentwickeln.

Die Nichteinhaltung dieser, ob absichtlich oder nicht, kann zu erheblichen Geldstrafen, Betriebsunterbrechungen und Schädigung der Reputation führen.

Updates

11.17.22

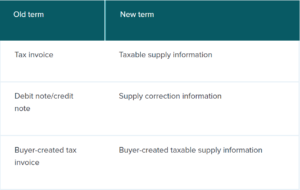

| Note that: businesses will not be required to change the wording on their tax invoices to reflect the new terms.

Note that: businesses will not be required to change the wording on their tax invoices to reflect the new terms.

04.28.22

|